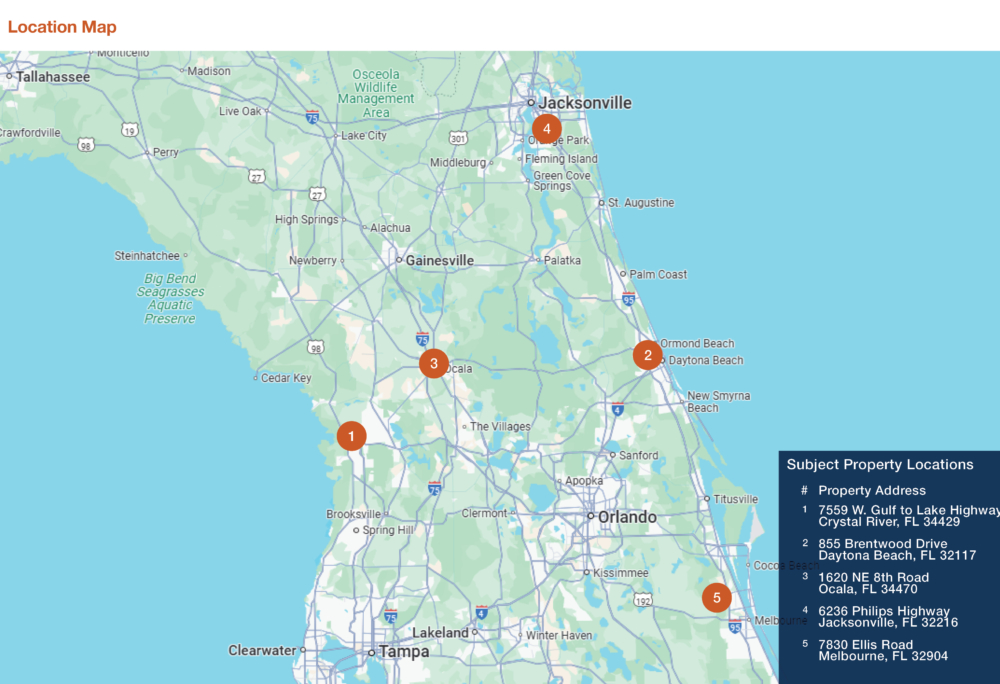

Winsupply – Value-Add Florida Portfolio

Crystal River, Dayton Beach, Ocala, Jacksonville, and Melbourne

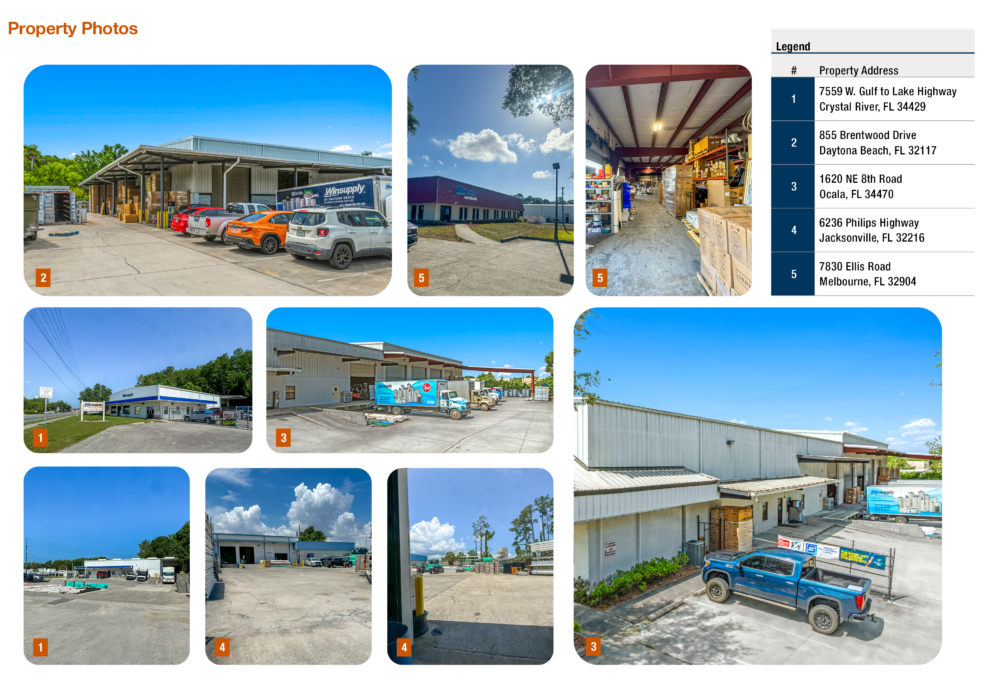

Property Description

Investment Highlights

**Properties are available to purchase individually or as a portfolio.**

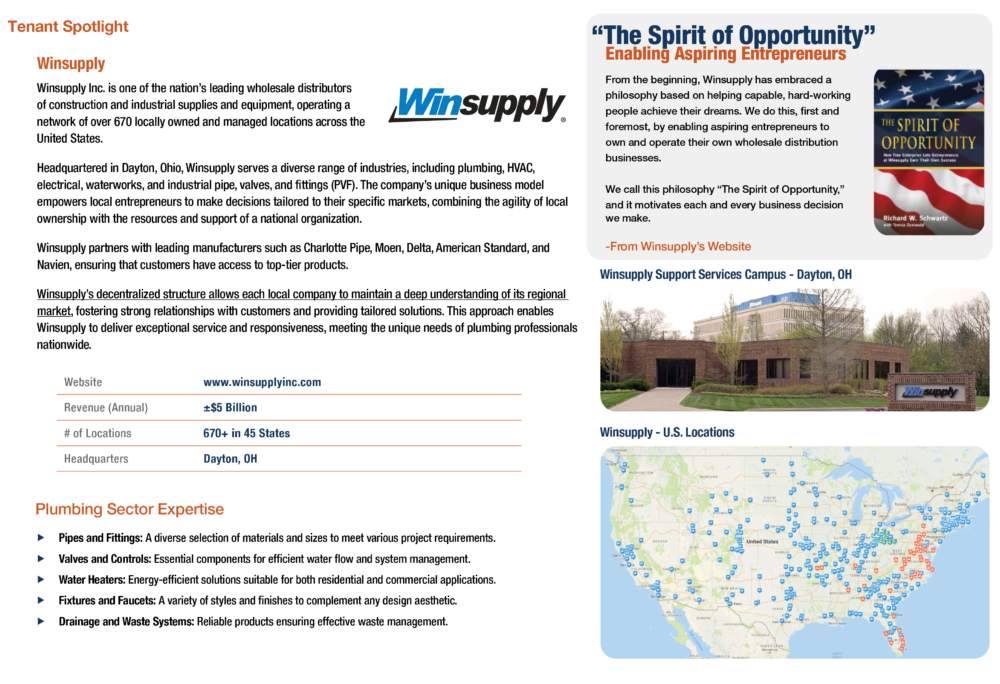

Premier 5-Property Industrial Portfolio Anchored by Winsupply – One of the Nation’s Largest Privately Held Wholesale Distributors of Construction and Industrial Supplies, Generating Over $5 Billion in Annual Revenue.

Value-Add Opportunity Through Lease Restructuring – Short-Term Leases and Below-Market Rents Provide Significant Upside Potential for Investors Seeking to Extend Terms or Re-Tenant at Market Rates.

Attractive Seller Financing Available – Flexible Seller-Financed Terms Offered — Contact Broker for Details and Structure.

High Credit Tenant

- National Credit Anchor – Each Asset Is Leased to Winsupply, a Top 10 U.S. Industrial Distributor With a National Footprint of Over 660 Locations

- Exceptional Operational Stability During Market Volatility – Winsupply Has Demonstrated Strong Performance Through the COVID-19 Pandemic and Previous Economic Recessions, Underscoring Its Long-Term Creditworthiness and Operational Durability

- Industry-Leading Market Position — Winsupply Ranks Among the Largest Plumbing and HVAC Distributors in the Country, Serving a Diverse Range of Commercial and Residential Contractors, Which Reduces Dependency on Any Single Customer Segment

Strong Real Estate Fundamentals

- Significant Rental Upside — Rents Below Market — Current In-Place Rents Are Significantly Below Market in Most Locations, Providing Substantial Mark-to-Market Potential for Investors Upon Lease Rollover

- Value-Add Timeline Within Reach — All Leases Are Short-Term and Have No Renewal Options, Allowing New Ownership to Reposition or Re-Lease at Full Market Value Within ~4 Years

- Passive, NNN-Leased Investment — All Leases Are Triple-Net (NNN), Offering Minimal Landlord Responsibilities and Predictable Cash Flow

- Strategic Florida Locations With Growing Demand — Located in High-Growth, Supply-Constrained Florida Submarkets With Strong Industrial Fundamentals and Rising Tenant Demand

- Tenant Commitment — The Tenant’s Operations Are Deeply Rooted in These Communities, With Locations Ideally Suited to Their Business, Minimizing the Likelihood of Relocation

Broker of Record: Ryan Nee – License: BK3154667

Contact Information

Craig Elster

Senior Director Investments

(949) 419-3223

[email protected]

License: CA 01958307