Watsco (NYSE: WSO) Portfolio – 17 Properties

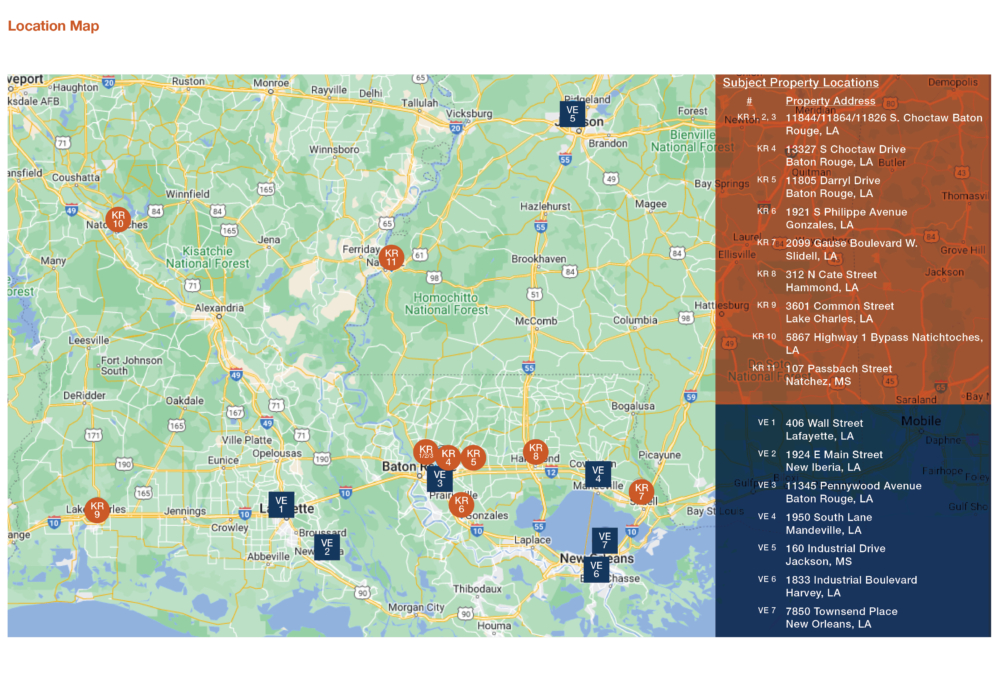

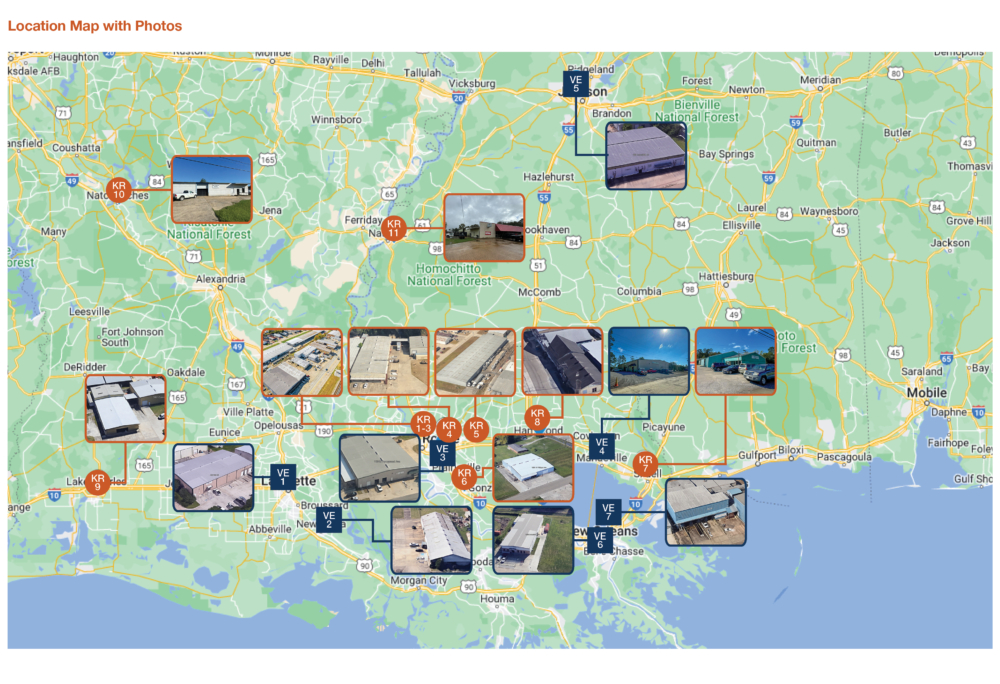

Please see OM for property addresses.

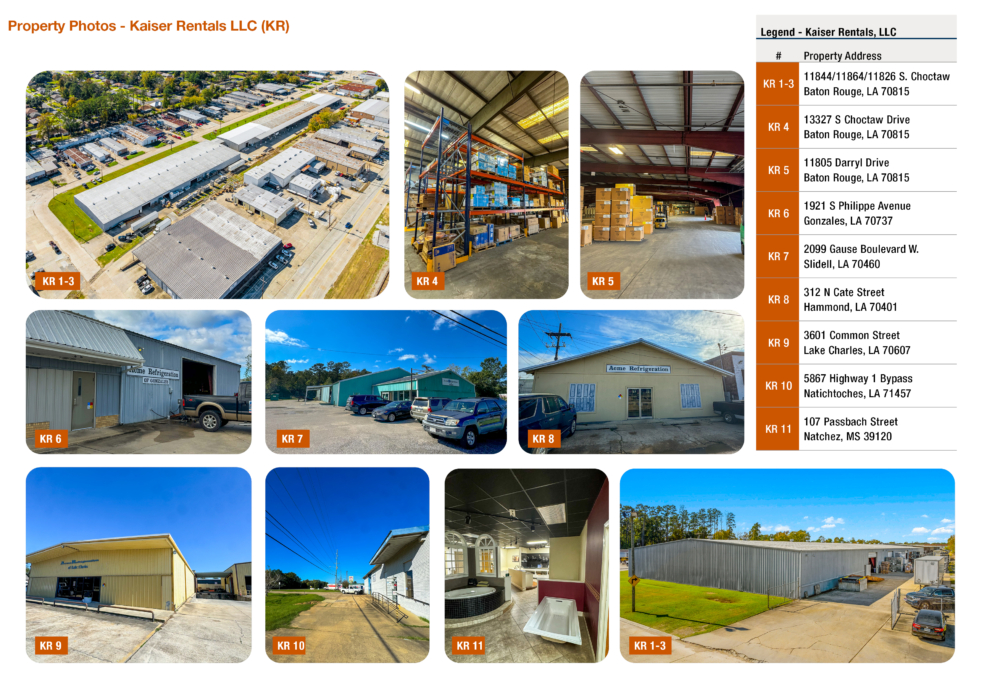

Property Description

Price: $13,553,851

Price Per/SF: $47.53

Land Area: ±22.19 Acres

Cap Rate: 7.07% Current | 14.81% Pro Forma

Gross Leasable Area: ±285,167 Square Feet

Investment Highlights

17-Property Portfolio Anchored by Watsco (NYSE: WSO) – A Leading Publicly Traded Tenant with Over $7 Billion in Annual Revenue and Over 600 Locations

Compelling 7% Cap Rate on Current Income | Current Rents are 50% Below Market, Offering Exceptional Upside Potential and a 14.81% Pro Forma Cap Rate

High Credit Tenant

- Corporate Strength: Acme Refrigeration is a Wholly-Owned Subsidiary of Watsco, a High-Credit Tenant with $7 Billion in Annual Revenue

- Market Dominance: The Largest HVAC/R Distributor in the Americas, Solidifying its Industry Leadership

- Publicly Traded Stability: Listed on the NYSE (WSO) with a Market Capitalization of $23+ Billion

- Economic Resilience: Watsco’s Diversified and Recession-Resilient Business Model Positions it for Sustained Performance in all Market Conditions

Strong Real Estate Fundamentals

- Established Market Presence: Each Location is Deeply Integrated into its Respective Market, Ensuring Strong Tenant Operations, Even in Rural Areas, Contributing to the Attractive Cap Rate

- Proactive Management: The Current Landlord has Maintained and Improved These Properties Meticulously, Including Expansions and Upgrades to Enhance Value and Operational Longevity

- Favorable Cost Basis: Current Rents are Significantly Below Market Levels—Often Half or Less of Market, Offering Substantial Upside Potential Through Rental Adjustments

- Tenant Commitment: The Tenant’s Operations are Deeply Rooted in These Communities, with Locations Ideally Suited to Their Business, Minimizing the Likelihood of Relocation

- Value-Add Potential: Strategy Includes Raising rents to Market Levels and Securing New Leases with Market-Rate Renewal Options, Driving Long-Term Income Growth and Portfolio Value

Brokers of Record:

- Steve Greer

- License: BROK.995710346-ACT

- 10527 Kentshire Court, Suite B, Baton Rouge, LA 70810

- Phone: (225) 376-6800

- William M. “Dickey” Davis

- License: B-15586

- 5100 Poplar Avenue, Suite 2505, Memphis, TN 38137

- Phone: (901) 620-3626

Contact Information

Craig Elster

Senior Director Investments

(949) 419-3223

[email protected]

License: CA 01958307

Ron Duong